Table of Contents

In the ever-evolving landscape of technological progress, businesses are fervently pursuing avenues to optimize efficiency, leading them to embrace Accounting Automation. This article scrutinizes the core facets of mastering Accounting Automation, unraveling the motivations behind its adoption, the pivotal components it entails, and the practical steps for its implementation. Accounting Automation is a commitment to revolutionize traditional financial processes, liberating professionals from mundane tasks through the deployment of Robotic Process Automation (RPA). Specialized software forms the crux, orchestrating approval workflow automation, customer-centric financial transactions, and procure-to-pay automation.

The journey involves meticulous selection of automation software, identification of processes for automation, and the utilization of a no-code platform for seamless customization. This transformative approach is not just a trend but an indispensable strategic imperative, ensuring businesses not only survive but thrive in the dynamic and competitive modern business landscape.

Why Accounting Automation Matters

Accounting Automation marks a paradigm shift in traditional processes, harnessing technology to streamline tasks and elevate efficiency. This transformative approach liberates finance professionals from mundane and repetitive operations, unlocking valuable time for strategic initiatives. By automating routine tasks such as data entry and reconciliation, Accounting Automation not only minimizes errors but also ensures a more reliable and agile financial framework. Finance teams can redirect their efforts towards high-value activities, fostering a proactive approach to decision-making and strategic planning. In essence, the efficiency gained through Automation enables businesses to optimize resource allocation, enhance accuracy, and stay agile in the face of evolving financial landscapes.

Enhanced Financial Processes

The adoption of Accounting Automation significantly improves financial processes. By automating routine tasks such as data entry, reconciliation, and reporting, businesses can ensure accuracy and reduce the risk of human errors, fostering a more reliable financial framework.

Robotic Process Automation (RPA)

Accounting Automation often involves the implementation of Robotic Process Automation (RPA). This technology empowers software robots to mimic human actions, executing rule-based tasks with speed and precision. RPA minimizes errors and accelerates the completion of routine financial activities.

What Constitutes Accounting Automation

Automation Software

Central to Accounting Automation is the utilization of advanced software designed to handle various accounting tasks. These tools not only streamline processes but also offer real-time insights into financial data, aiding informed decision-making.

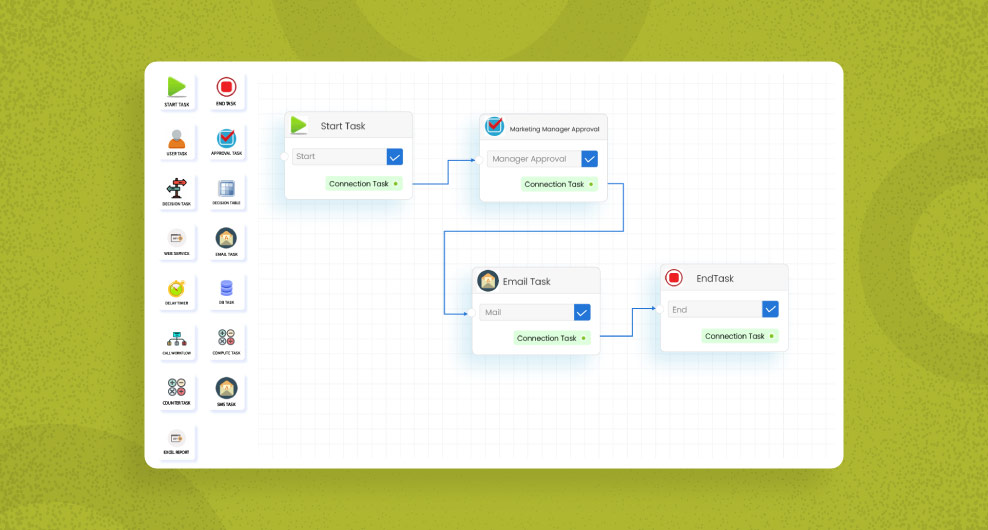

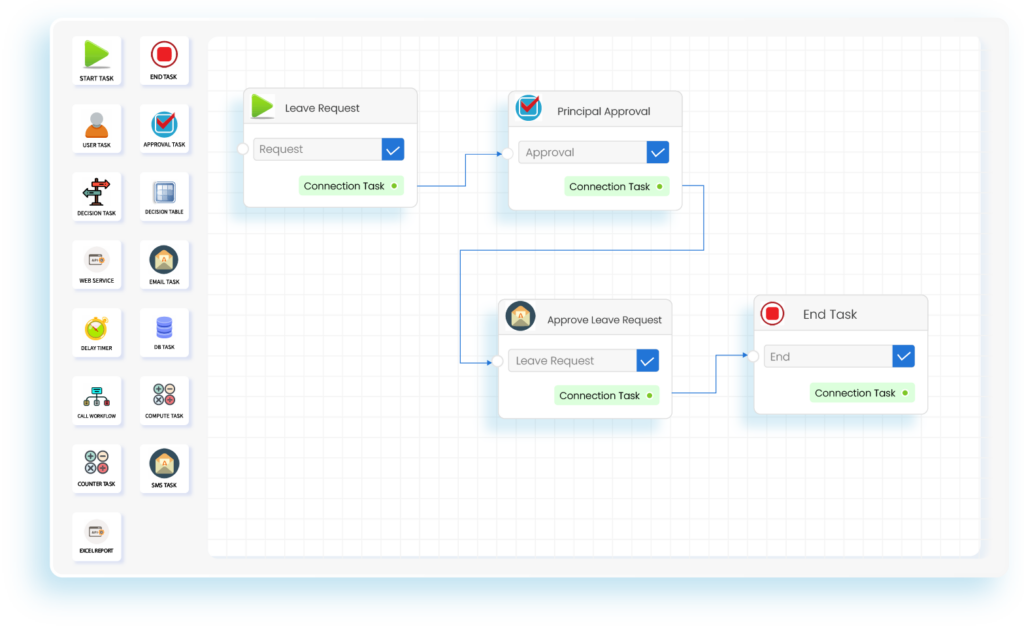

Approval Workflow Automation

Accounting often involves multiple layers of approval. Automation of approval workflows ensures a seamless and standardized process. This not only accelerates decision-making but also enhances transparency and accountability.

Customer Experience in Financial Transactions

With Accounting Automation, businesses can elevate the customer experience in financial transactions. Automated invoicing, prompt billing, and efficient payment processing contribute to a positive and professional interaction between the business and its clients.

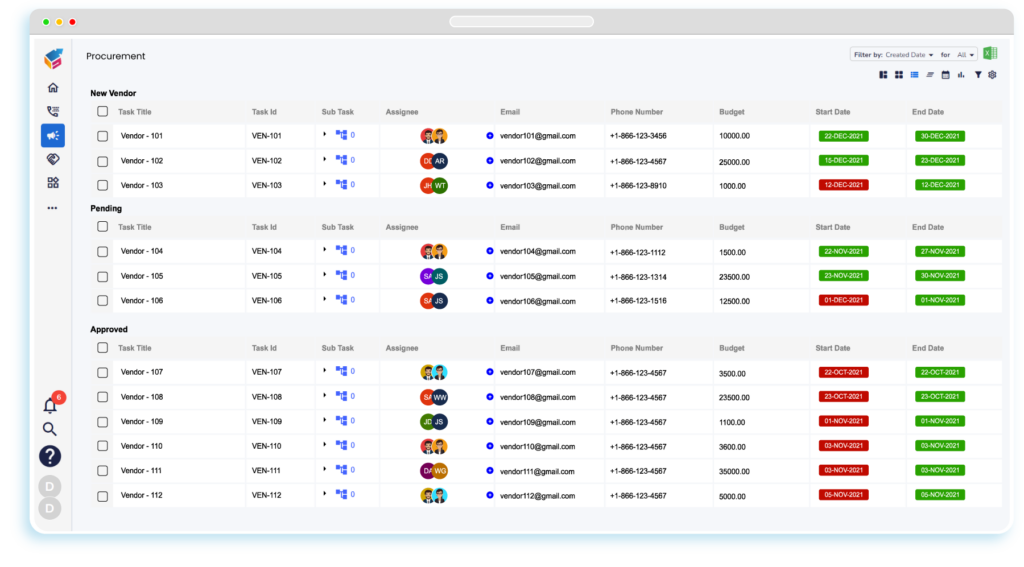

Procure-to-Pay Automation

Streamlining the procurement process is crucial for effective financial management. Accounting Automation includes features like Purchase Order automation and Procure-to-Pay solutions, optimizing the end-to-end procurement lifecycle.

Workflow Automation

Beyond accounting-specific tasks, implementing broader workflow automation ensures a cohesive and interconnected business environment. No-code platforms enable the creation of custom workflows tailored to the unique needs of the organization.

How to Implement Accounting Automation

Choose the Right Automation Software

Selecting the appropriate automation software is the foundational step. Evaluate options based on the specific needs of the business, considering scalability, integration capabilities, and user-friendliness.

Identify and Prioritize Processes

Identify key accounting processes that can benefit most from automation. Prioritize tasks that are repetitive, time-consuming, and prone to errors, as these provide the greatest return on investment.

Utilize a No-Code Platform

No-code platforms empower non-technical users to create and customize automated workflows. This democratization of automation ensures that business users can actively contribute to the design and implementation of automated processes.

Integrate Payroll and Expense Management

Accounting Automation should extend to critical areas such as payroll and expense management. By integrating these processes, businesses can achieve comprehensive financial automation, reducing manual intervention and potential errors.

Conclusion

Mastering Accounting Automation transcends a mere trend; it stands as a strategic imperative for businesses seeking prosperity in today’s competitive landscape. Delving into the reasons, components, and implementation methods of Accounting Automation is pivotal for unlocking heightened efficiency, accuracy, and customer satisfaction. Embracing this transformative approach is not an elective choice; rather, it is the indispensable key to fostering agility and resilience amidst evolving business challenges. In a world driven by technological advancements, organizations that grasp the significance of Accounting Automation position themselves not only to survive but to thrive, ensuring they remain adaptive and robust in the dynamic business environment.