Table of Contents

Just like many other financial processes, managing invoices has become a significant burden. According to a survey, 82% of finance departments feel overwhelmed by the sheer volume of invoices they receive daily, as well as the various formats in which they are submitted.

Despite good intentions, companies have cobbled together invoice management systems that end up complicating everyone’s lives. These systems were never meant to be long-term solutions; they were simply the best available at the time.

However, it’s time to move past manual data entry and redundant processes. Every aspect of invoice management that hinders your business can be remedied. In this article, we will demonstrate how.

What is invoice management?

Invoice management is the process of handling and overseeing the receipt, processing, and payment of invoices from suppliers or vendors. It involves tasks such as verifying the accuracy of invoices, matching them with purchase orders and delivery receipts, obtaining approval for payment, and processing payments in a timely manner. Effective invoice management helps organizations ensure that they pay their suppliers accurately and on time, maintain good relationships with vendors, and avoid late payment fees or other financial penalties.

How the invoice management process has changed

The invoice management process has undergone significant changes, driven by technology and evolving business needs. Traditional manual methods have given way to more automated, efficient, and streamlined approaches. Here’s how the process has transformed:

- Digitalization: Invoices are now primarily received and processed in digital formats, reducing the reliance on paper-based documents.

- Automation: Technologies like OCR (Optical Character Recognition) and AI (Artificial Intelligence) are used to automate data entry, extraction, and validation processes, minimizing manual intervention and errors.

- Centralization: Centralized invoice management forms allow for better control, visibility, and tracking of invoices across the entire organization.

- Integration: Invoice management systems are often integrated with other business systems such as accounting software and ERP (Enterprise Resource Planning) systems, enabling seamless data flow and process synchronization.

- Mobility: Mobile applications and cloud-based solutions enable remote access to invoice processing systems, facilitating faster approval and payment processes.

- Compliance: Automation ensures that invoices comply with regulatory requirements and internal policies, reducing the risk of errors and non-compliance.

- Analytics: Advanced analytics tools are used to gain insights into invoice processing metrics, helping organizations optimize their processes and make informed decisions.

Overall, these changes have made the invoice management process more efficient, accurate, and transparent, benefiting both businesses and their suppliers.

How the invoicing process should look in 2024

In 2024, the invoicing process should be highly streamlined, automated, and integrated with other business systems. Here’s how it might look:

- Blockchain Integration: Integration of blockchain technology to create secure, transparent, and tamper-proof invoicing processes. This could streamline verification and reduce fraud.

- AI-powered Predictive Analysis: Utilization of artificial intelligence for predictive analysis of invoicing patterns, allowing businesses to forecast cash flow and plan budgets more effectively.

- Augmented Reality for Verification: Use of augmented reality (AR) for invoice verification, allowing users to visually inspect goods or services delivered against the invoice, improving accuracy and reducing disputes.

- Mobile Invoicing Apps: Adoption of mobile apps for invoicing, enabling users to create, approve, and track invoices on-the-go, increasing flexibility and speed.

- Environmentally Sustainable Practices: Implementation of environmentally sustainable practices, such as electronic invoicing and digital archiving, to reduce paper usage and carbon footprint.

- Integration with Ecosystem Partners: Greater integration with ecosystem partners, such as suppliers and logistics providers, for seamless exchange of invoice-related information, enhancing collaboration and efficiency.

- Personalized Invoicing Experiences: Customization of invoicing experiences based on customer preferences, such as personalized invoices or payment options, to improve customer satisfaction and loyalty.

- Continuous Process Improvement: Emphasis on continuous process improvement through data analytics and feedback mechanisms, leading to ongoing optimization of the invoicing process.

The invoicing process in 2024 is highly efficient, transparent, and scalable, enabling organizations to manage their finances more effectively while maintaining strong relationships with suppliers.

The benefits of automated invoice processing

Automated invoice processing offers several key benefits for organizations:

- Time and Cost Savings: Automation reduces the need for manual data entry and processing, saving time and reducing labor costs.

- Improved Accuracy: Automated systems are less prone to errors than manual processes, leading to more accurate invoice processing and reduced risk of overpayments or duplicate payments.

- Faster Processing Times: Automation speeds up the invoice processing cycle, allowing organizations to pay invoices more quickly and take advantage of early payment discounts.

- Enhanced Visibility and Control: Automated invoice processing systems provide real-time visibility into the status of invoices, allowing organizations to track and manage invoices more effectively.

- Streamlined Approval Workflows: Automated approval workflows ensure that invoices are routed to the appropriate approvers in a timely manner, reducing delays and bottlenecks.

- Better Compliance: Automated invoice management system can help ensure that invoices comply with regulatory requirements and internal policies, reducing the risk of non-compliance.

- Improved Supplier Relationships: Faster, more accurate processing can lead to improved relationships with suppliers, who benefit from quicker payments and smoother transactions.

Automated invoice processing can help organizations streamline their accounts payable processes, reduce costs, and improve efficiency and accuracy.

Move beyond tedious invoice management

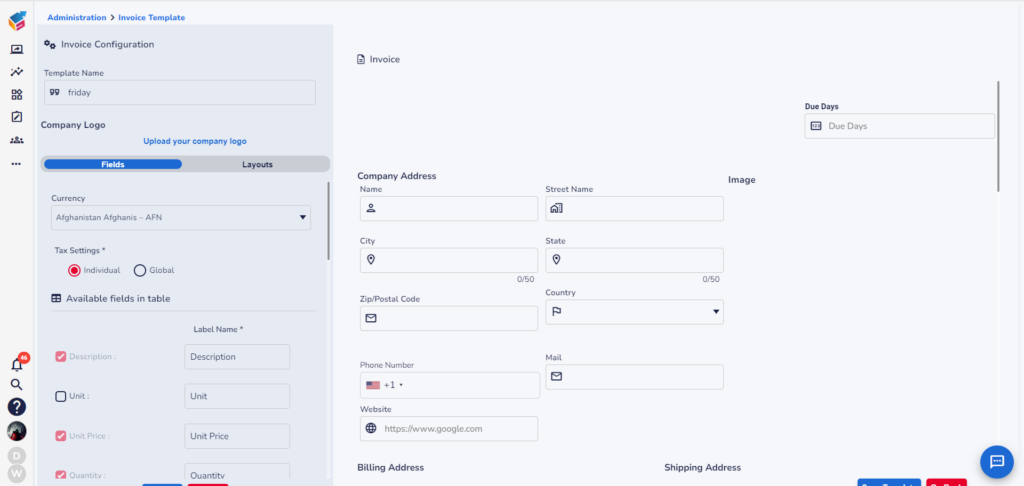

Yoroflow’s accounting software integrates invoices into the broader spend management process, eliminating the need for a separate platform. Team members can upload and approve invoices within the same tool used for expense claims and other fund requests, streamlining the process.

Since all spending is company-related, this approach simplifies workflow and ensures consistency.

Any user can upload a supplier invoice using Yoroflow, not just the finance or AP team. The system automatically extracts key information from the document and sends it to the budget manager for approval, then to the finance team for payment and archiving.

This process eliminates internal emails and manual data entry, allowing for quick invoice handling.

This seamless integration is ideal for businesses looking to manage invoices efficiently as part of their overall spend management strategy.