Table of Contents

In the digital world, online payment gateways have become an essential component of e-commerce and online transactions. These gateways serve as the intermediary between merchants and customers, facilitating secure and convenient online payments.

Let’s delve into the world of online payment gateways, how do they work, and what benefits do they offer?

What are online payment gateways?

An online payment gateway is a software application that facilitates the secure processing of online payment transactions between customers and merchants. It acts as an intermediary between the customer’s chosen payment method (such as credit card, debit card, or digital wallet) and the merchant’s bank account, securely transmitting payment information and authorizing transactions in real-time.

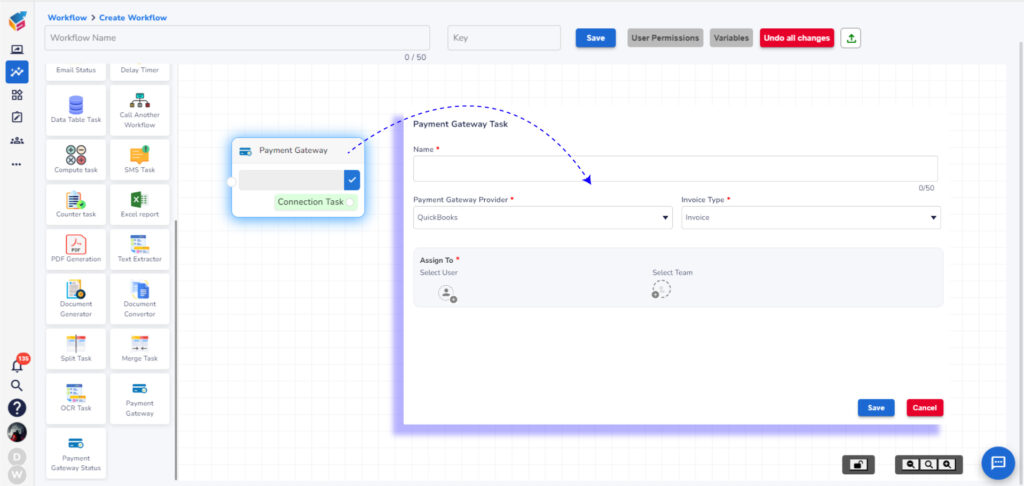

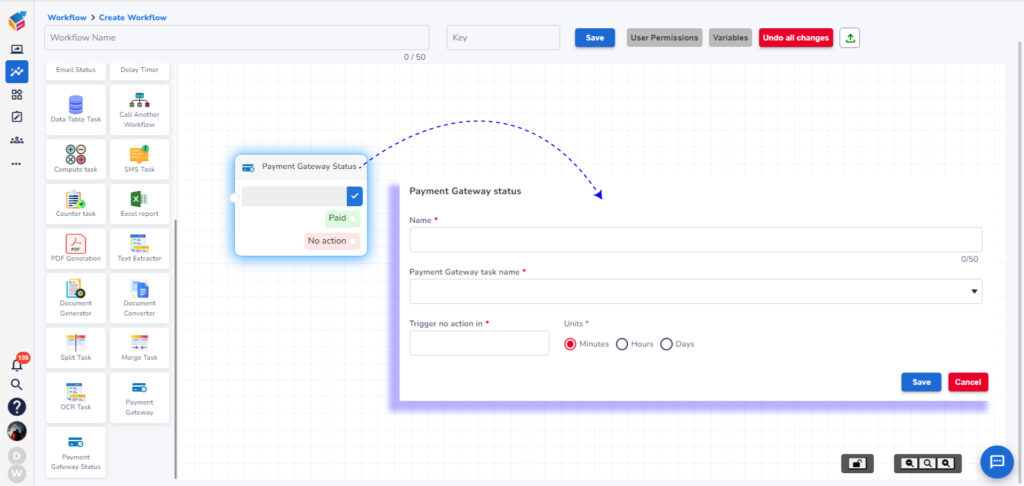

Nowadays, there is a growing trend in the adoption of various workflow automation software like Yoroflow. Payment gateway integration in Yoroflow provides a comprehensive solution for businesses seeking streamlined workflow management coupled with secure online payment processing. These gateways are seamlessly incorporated as integral features within Yoroflow’s framework, offering users a convenient drag-and-drop functionality for effortless utilization.

Difference between payment gateway and payment processor

Payment gateways facilitate the secure transmission of payment data between merchants and payment processors, while payment processors handle the actual processing, authorization, and settlement of payment transactions. Both components are essential for enabling online payments and ensuring a smooth and secure checkout experience for customers.

How do online payment gateways work?

When a customer makes a purchase online, the payment process typically involves several steps:

- Initiation: The customer selects their desired products or services and proceeds to the checkout page to make a payment.

- Data encryption: The payment gateway encrypts the customer’s payment information, such as credit card details or bank account information, to ensure secure transmission over the internet.

- Authorization: The encrypted payment data is transmitted to the payment gateway, which then forwards it to the customer’s bank for authorization.

- Authentication: The customer’s bank verifies the authenticity of the payment request and checks if the customer has sufficient funds to complete the transaction.

- Transaction processing: Upon approval from the customer’s bank, the payment gateway provider processes the transaction and sends a confirmation message to the merchant.

- Settlement: The funds are transferred from the customer’s bank account to the merchant’s account, completing the payment process.

Benefits of online payment gateways

Convenience

Online payment gateways offer unparalleled convenience to both merchants and customers. Customers can make purchases from the comfort of their homes or on the go, using various payment methods such as credit cards, debit cards, digital wallets, or bank transfers. For merchants, online payment gateways streamline the checkout process, reducing friction and increasing conversion rates. Utilizing these payment gateway tools within the workflow assists the team in optimizing the customer’s workflow process.

Security

Security is paramount in online transactions, and reputable payment gateways employ robust security measures to protect sensitive payment data from unauthorized access or fraud. Encryption techniques, secure sockets layer (SSL) certificates, and tokenization are commonly used to safeguard payment information, instilling confidence in both merchants and customers.

Global reach

Online payment gateways enable businesses to reach customers worldwide, transcending geographical boundaries and expanding their market reach. By accepting multiple currencies and supporting international payment methods, merchants can cater to a diverse customer base and capitalize on global opportunities.

Faster transactions

With online payment gateways, transactions are processed in real-time, allowing merchants to receive payments instantly and accelerate cash flow. This eliminates the need for manual intervention, or delays associated with traditional payment methods such as checks or bank transfers, enabling businesses to operate more efficiently.

Enhanced customer experience

A seamless and secure payment experience is integral to customer satisfaction and loyalty. Online payment gateways offer a frictionless checkout process, reducing cart abandonment rates and fostering positive shopping experiences. Features such as one-click payments, guest checkout, and recurring billing further enhance the convenience for customers, driving repeat business and referrals.

Integration capabilities

Many online payment gateways offer seamless integration with e-commerce platforms, shopping carts, and accounting software, simplifying the setup process for merchants and streamlining payment management. Payment gateway API integrations enable businesses to customize and extend the functionality of their payment systems, catering to specific requirements and enhancing operational efficiency.

Data insights

Online payment gateways provide valuable insights into customer behavior, transaction patterns, and sales performance, empowering merchants to make informed decisions and optimize their business strategies. By analyzing transaction data and monitoring key metrics, businesses can identify trends, detect anomalies, and tailor their marketing efforts to drive growth. Payment gateways integrated tools make the payment tracking task easier.

Try secure online payment gateways

Online payment gateways play a pivotal role in enabling secure, convenient, and efficient online transactions. The integration of payment gateways into Yoroflow offers a seamless solution for businesses looking to streamline their workflow processes while securely managing online payments.

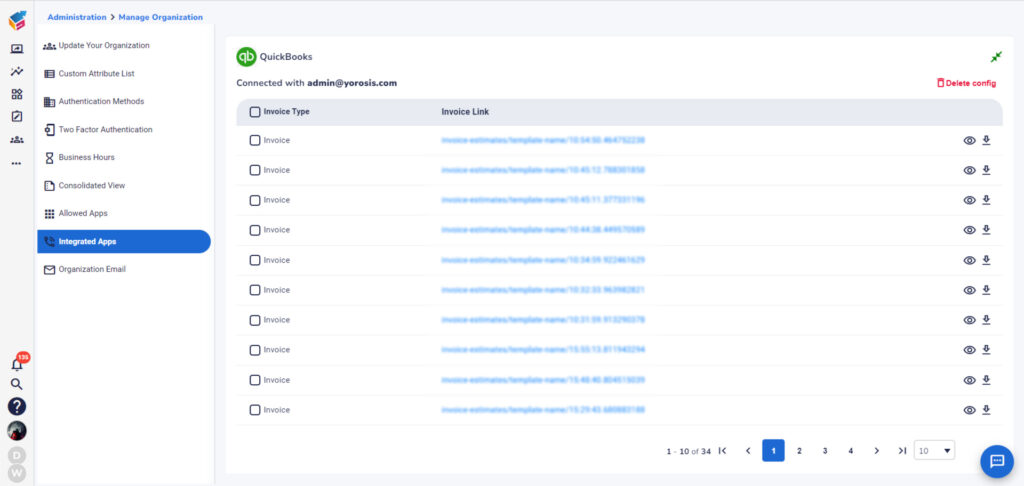

Moreover, the QuickBook integration within Yoroflow serves to bolster the effectiveness of tasks related to accounts, further enhancing operational efficiency.

With built-in features and a user-friendly interface, Yoroflow empowers teams to efficiently automate customer transactions, enhancing overall productivity and customer satisfaction. By leveraging the capabilities of payment gateways within Yoroflow, businesses can effectively manage their financial transactions and drive growth in a fast-paced digital environment.